Estimated reading time: 4 minutes

Thank you for reading this post, Please bookmark onetrader.in website for regular updates!

“Anant Raj Limited” is actually a hidden gem real estate + data centre play, and writing a business breakdown article — because 90% investors don’t know how exactly it makes money.

🏢 How Anant Raj Makes Money: Business Model, Revenue Streams & Future Growth Explained:

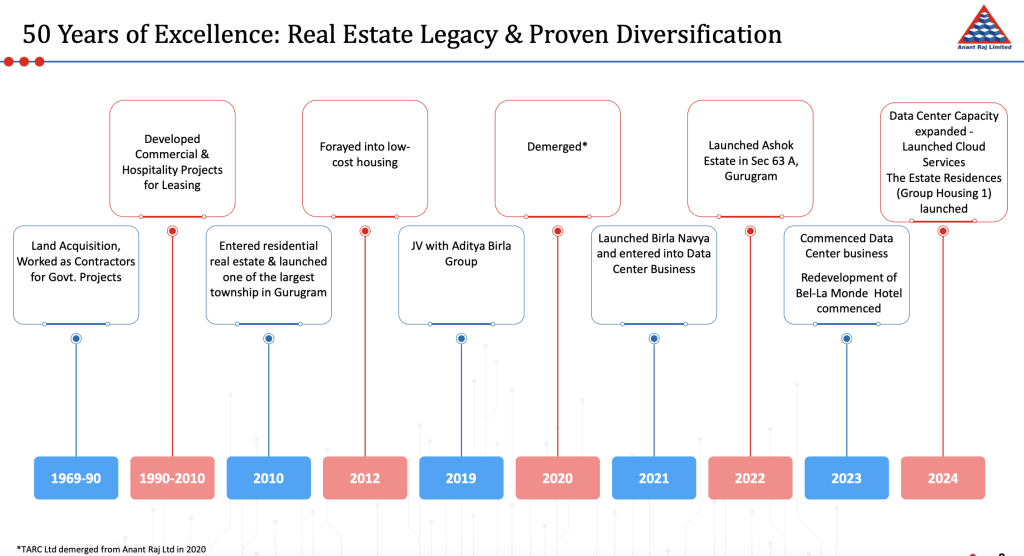

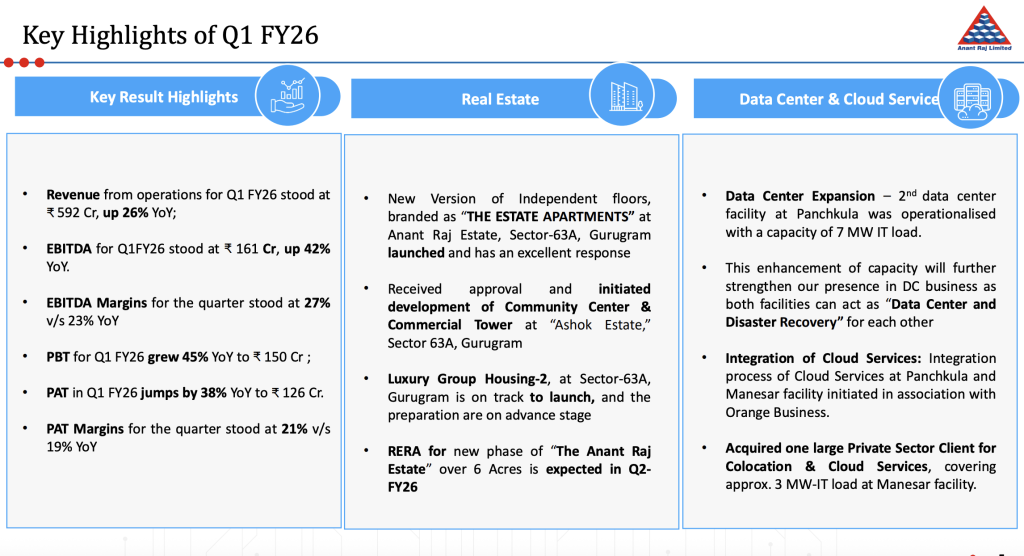

Anant Raj Limited is one of India’s oldest and most underrated real estate developers — but it’s no longer just a traditional builder. Today, it’s transforming itself into a diversified infrastructure and data-centre powerhouse with deep land banks, recurring rental income, and exposure to next-generation digital infrastructure.

In this article, let’s decode how Anant Raj earns money, its core business model, revenue breakdown, risks, and growth potential — so you can understand the company like a pro investor.

🏙️ Company Overview

| Detail | Info |

|---|---|

| 📍 Founded | 1969 |

| 🏢 Headquarters | New Delhi, India |

| 🏗️ Business Areas | Real Estate, Commercial Leasing, Industrial Parks, Data Centres |

| 📊 Market Cap | ~₹20,000+ crore (2025) |

| 📈 Listed On | NSE & BSE |

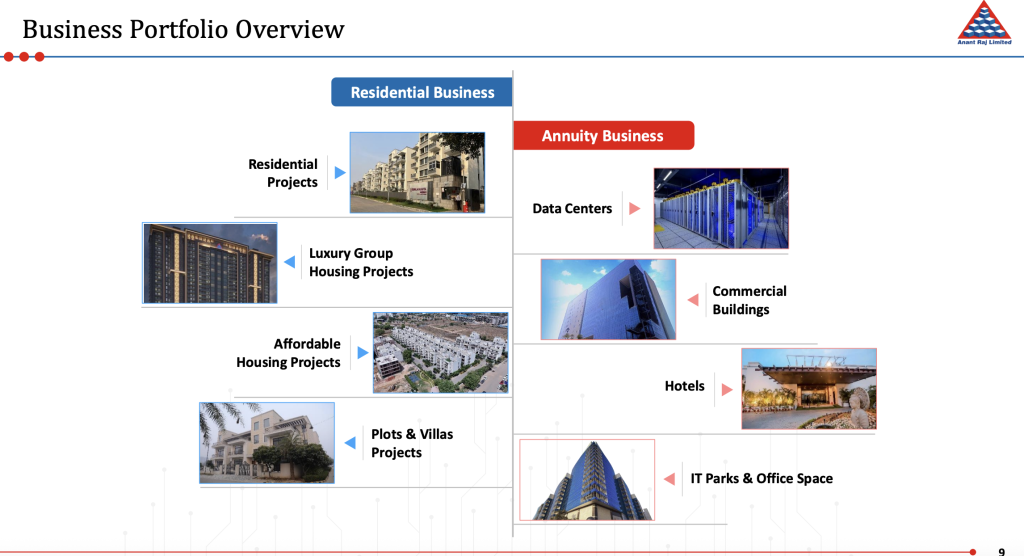

🔑 1. Real Estate Development (Core Business):

This is Anant Raj’s legacy and still its largest revenue contributor.

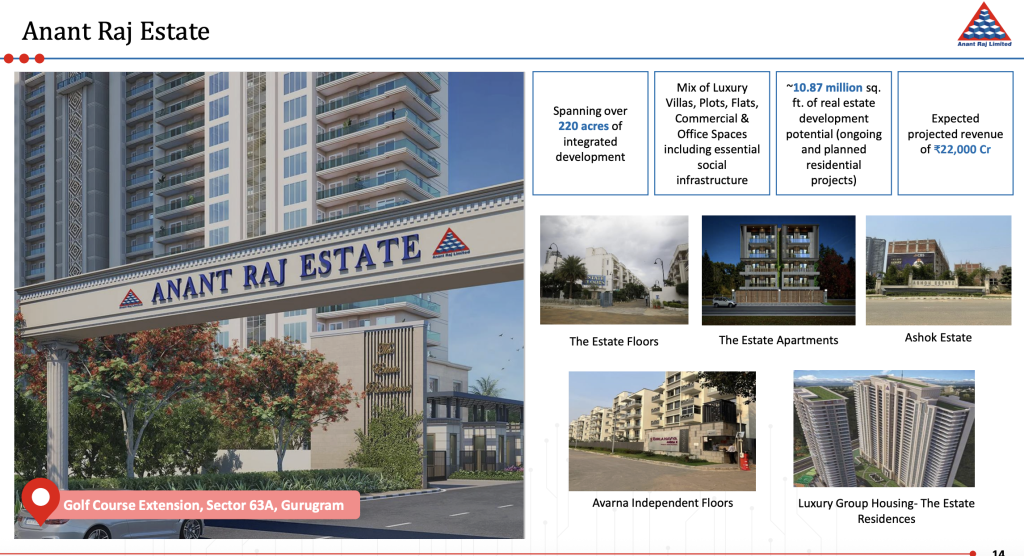

It develops residential, commercial, retail, and township projects across Delhi NCR, Gurugram, and Haryana.

💰 How it makes money:

- Sale of residential apartments, villas, and plotted developments

- Sale of commercial office and retail space

- Development charges, parking fees, and facility services

✅ Key Points:

- Owns massive land bank (~1000+ acres) acquired decades ago at very low cost.

- This gives huge profit margins when land is monetised now.

- Revenue is lumpy but large when projects complete.

How IRCTC Makes Money – Business Model Explained

🏢 2. Commercial Leasing (Recurring Income Engine):

Unlike typical real estate developers, Anant Raj also leases office buildings, retail complexes, and IT parks to corporate tenants.

💰 Revenue Streams:

- Monthly rentals & lease income

- Maintenance and facility charges

- Escalation clauses in long-term contracts

✅ Why it’s important:

- Provides steady cash flow even when property sales slow down.

- Helps reduce cyclicality of real estate revenue.

🏭 3. Industrial & IT Parks:

The company builds industrial parks, warehousing, and IT special economic zones (SEZs). These cater to logistics, manufacturing, and tech companies.

💰 Revenue Sources:

- Sale or lease of industrial plots and sheds

- Annual maintenance charges

- Ancillary services (power, utilities, etc.)

✅ Industrial parks are in demand due to “Make in India” and supply-chain localisation — a strong growth driver.

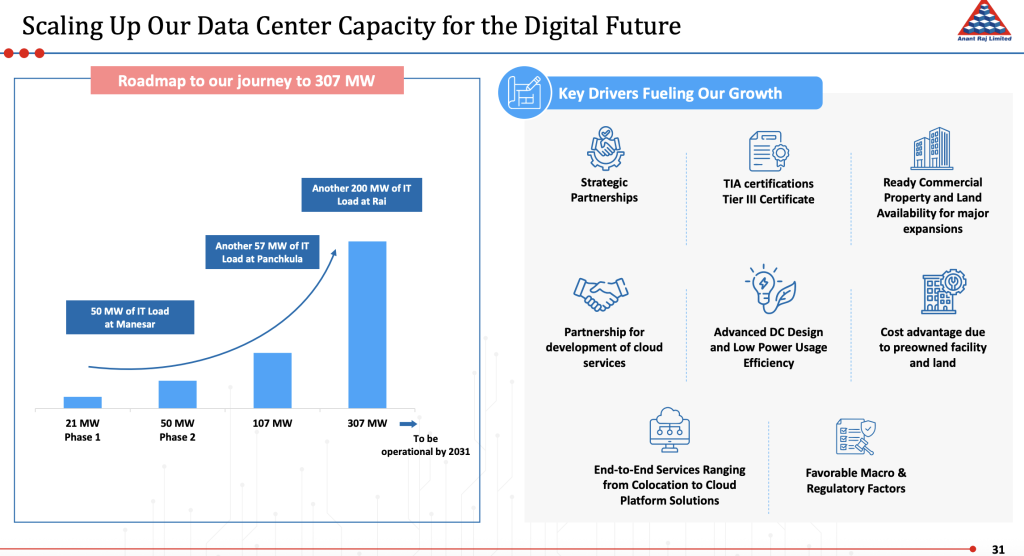

🖥️ 4. Data Centres – The Future Growth Engine: 🚀

The most exciting part of Anant Raj’s future is its data centre business — run by its subsidiary Anant Raj Cloud Ltd.

📡 Business Model:

- Builds Tier-III & Tier-IV data centre facilities.

- Leases space (“colocation”) to cloud companies, telecom firms, fintech, and enterprises.

- Charges clients for power, cooling, connectivity, and managed services.

✅ Why This Matters:

- Data centres are high-margin, long-term contracts (5–10 years).

- India’s digitalisation + AI boom = huge demand for such capacity.

- Company targets 300+ MW capacity over the next few years.

📊 Revenue Mix (Approx.):

| Segment | Contribution |

|---|---|

| Real Estate Sales | ~50–55% |

| Leasing & Rentals | ~15–20% |

| Industrial Parks | ~10% |

| Data Centres & Others | ~15–20% (and rising fast) |

(Varies year to year)

🧠 Moats & Competitive Advantages:

| Advantage | Why It Matters |

|---|---|

| 🏞️ Large Land Bank | Bought decades ago, gives high profit margin |

| 📍 Strategic Locations | NCR-centric land parcels near tech & logistics hubs |

| 🏗️ Integrated Model | Sales + Leasing + Industrial + Data Centre |

| 🔄 Recurring Income | Rental + data centre colocation = stable cash flow |

| 🚀 Future-Ready | Early mover in India’s data centre infrastructure market |

⚠️ Key Risks:

- Real estate remains cyclical — project delays or demand slowdowns can hurt revenue.

- Regulatory approvals and land litigation risks.

- Data centre business requires heavy upfront capex.

- Rising interest rates could impact margins on new projects.

📈 Future Growth Drivers:

- Monetisation of large land bank into new residential & commercial projects.

- Rapid expansion of data centre capacity — one of the most scalable verticals.

- Growth in leasing income as IT/office demand rises.

- Government push for industrial corridors & Make in India.

📊 Investor Takeaway:

Anant Raj is no longer just a typical builder — it’s evolving into a real estate + digital infrastructure hybrid. The company enjoys:

- Deep land reserves

- Recurring cash flows from leasing

- Explosive optionality in the data centre space

While cyclical risks remain, its strong asset base and forward-looking expansion make it a compelling long-term story in India’s infrastructure and digital growth themes.

✅ Verdict:

For investors with a 3–5+ year horizon, Anant Raj is a business worth tracking — especially as data centres start contributing a bigger chunk of profits.

How IRCTC Makes Money – Business Model Explained